- Quantum Campus

- Posts

- Who's primed? Six American regions ready to host tomorrow's quantum computers

Who's primed? Six American regions ready to host tomorrow's quantum computers

Datacenter-management leader assesses the global landscape

Quantum Campus shares the latest in quantum science and technology. Read by more than 1,700 researchers, we publish on Fridays and are always looking for news from across the country. Advertising and sponsorship opportunities are available.

Who’s primed?

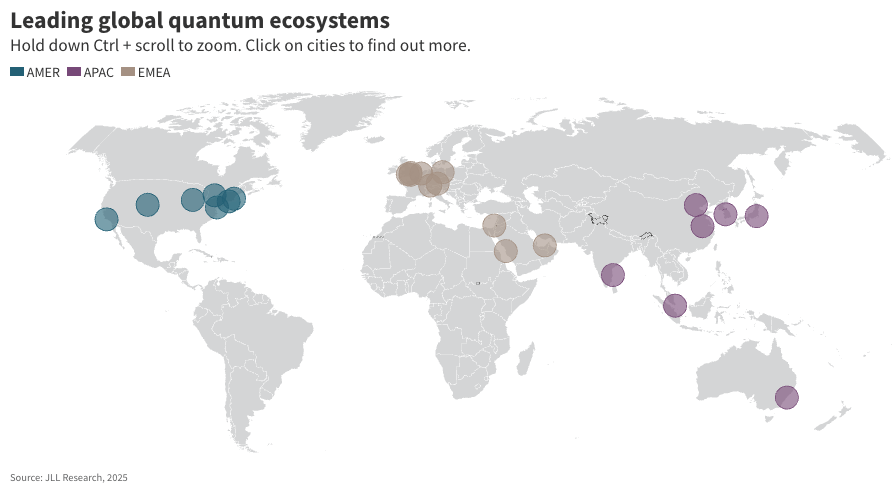

Six regions of the United States are best suited to host the datacenters for quantum and classical-quantum hybrid computers in the coming decades, according to JLL, which manages more than 250 datacenters worldwide.

They are:

Boston, with Quantinuum, Quantum Machines, and QuEra Computing anchoring its efforts.

Chicago, having secured more than $1 billion in quantum investments recently.

Colorado, and its 3,000 person quantum workforce.

Maryland, led by the University of Maryland, JQI, NIST, NSA, and DARPA.

New Haven, and its “crucial public-private partnership” QuantumCT.

Southern California, with its “extensive list of pure-play quantum companies.“

A “nurturing environment is needed to support quantum ecosystems as they mature. The leading quantum markets have all the ingredients,” the real-estate company said in a report released in July. The ingredients assessed in the report included: academic programs; established quantum companies and startups; infrastructure like cryogenic facilities, access to power, and lab space; public and private advocacy around economic development; government support; and a sufficient workforce to sustain industry growth.

The report also shared about 15 other regions around the world ready for quantum datacenters, including:

Daejeon, South Korea, hub of a strategic collaboration among Pasqal, Norma, and KAIST.

Delft, Netherlands, as the EU’s “quantum flagship.”

Hefei, China, home to China’s premier quantum hardware developments.

Sydney, Australia, with its “Quantum Academy” uniting UNSW, University of Sydney, UTS, and Macquarie University.

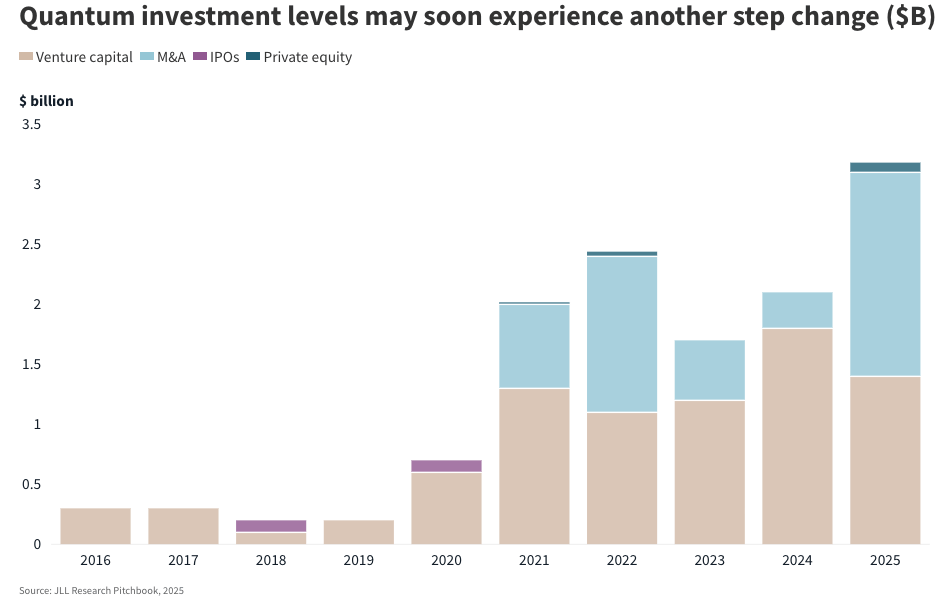

“While great opportunity can be seen on the horizon, for now quantum remains a nascent industry. Quantum companies generated under $750 million in revenue in 2024. But excitement in the industry is growing. Startups focused on quantum technology attracted about $2 billion in 2024,” JLL’s report said. It cautioned that “the point where QPUs become a common component in many data centers [is] likely 10 years or more in the future.”

A June report from McKenzie argued that significant interest from national investment entities backing private companies also indicated future industry growth. It cited: SoftBank’s partnership with Quantinuum, Aramco’s investment in Pasqal, the Japanese National Institute of Advanced Industrial Science and Technology’s collaboration with QuEra and IonQ, and the Qatar Investment Authority’s partnership with Alice & Bob.

“There’s going to be a defined point in time where we’ve reached commercialization of the technology, where there’s commercial utility, and at that point we see a significant ramp taking place to the scale of like what we saw with artificial intelligence,” Andrew Batson, head of data center research at JLL told CNBC this week. “We see the private sector play really married to the point at which commercialization of the product takes place.”

Quantum Campus is edited by Bill Bell, a science writer and marketing consultant who has covered physics and high-performance computing for more than 25 years. Disclosure statement.